French political thinker Alexis de Tocqueville rightly warned in the earliest days of the American republic that democracy can endure up to the point when “politicians realize they can bribe people with their own money.”

French political thinker Alexis de Tocqueville rightly warned in the earliest days of the American republic that democracy can endure up to the point when “politicians realize they can bribe people with their own money.”

It’s a good thing the Frenchman didn’t have to also factor in the poisonous influence of multilateral institutions, such as today’s Inter-American Development Bank (IBD). He might have abandoned all hope.

Tocqueville’s perceived threat to democracy has not yet crippled the U.S. But he was prescient about the inherent risks. Think Greece and Argentina—and now the seemingly stable Costa Rica.

Latin America is littered with once-promising nations brought low by self-indulgence. But Costa Rica, the so-called Switzerland of Central America, was supposed to be above it all. While the rest of the isthmus was immersed in guerrilla wars in the 1980s, Costa Rica enjoyed peace. That stability and the country’s better-educated population put it well ahead of its neighbors in the post rebel-war period.

Now the education and health gap that once existed between Costa Rica and the rest of the region is disappearing and the Tocqueville effect seems to be at the heart of the problem. Since January, the government of President Laura Chinchilla of the National Liberation Party (PLN) has been pushing a package of sharp tax increases to fund a spike in government spending.

The IDB seems to approve. A statement released from its country representative on Friday said that the bank “does not advocate a specific tax burden or tax policy.” But IDB tax expert Alberto Barreix has twice visited the country this year to endorse the Chinchilla plan, calling it “a heck of a tax reform.” He has also said that Costa Rica needs a tax burden similar to Argentina’s.

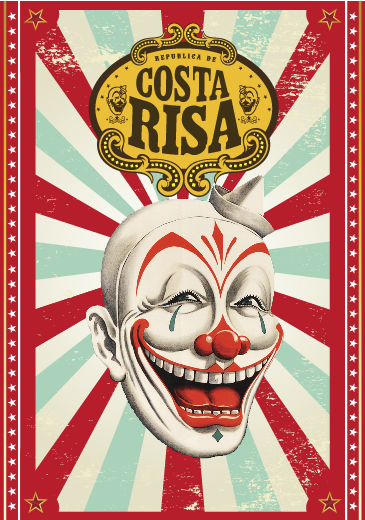

Some Costa Ricans know better: A coalition of antitax activists has launched a public information counteroffensive to inform citizens of the cost of the tax hike. A video called “Costa Risa,” literally “Laugh Coast,” that mocks the political class has gone viral on the Internet.

Whether the tropical tea party can prevail is far from clear, but its struggle ought not to be ignored, because it is a microcosm of a threat to the entire region. Geniuses from Washington’s multilateral community have decided that poor countries cannot become rich countries unless their governments impose heavy tax burdens on the locals, and these “bankers” are using rich-country resources to make it happen.

Costa Rica’s official tax stats are deceptive. In 2008 the central government’s revenues equaled only 15.9% of gross domestic product. But as Cato Institute scholar Juan Carlos Hidalgo pointed out in a January op-ed in the Costa Rican daily La Nación, that number doesn’t include local taxes or taxes paid to government entities like the Institute for Tourism and the Institute for Agrarian Development. Nor does it include social security taxes, which rich countries include when they discuss their tax-to-GDP ratios.

Tally up the total take and, according to Mr. Hidalgo, the burden for Costa Ricans in 2008 was 23.1% of GDP. In recessionary 2009 it fell to 21.7%. Compare that to the U.S. overall tax burden of 26.1% in 2008 and 24% in 2009 (the latest year for which Organization for Economic Co-operation and Development figures are available), and it is clear that Costa Ricans are not undertaxed.

Nevertheless, the country’s fiscal deficit as a percentage of GDP rose to 3.5% of GDP in 2009 from only 0.2% in 2008. In 2010, according to the United Nation’s Economic Commission on Latin America, Costa Rica’s fiscal deficit was 5.2%, the highest in Latin America. The government forecasts a deficit of 5.5% in 2012.

The problem is government spending. While revenues as a percentage of GDP are forecast to be 7.5% lower this year than they were in 2008, expenditures as a percentage of GDP are expected to come in 29.4% higher. Most of that money is going into an expanded bureaucracy, which grew by 20% during the previous PLN government of Oscar Arias. Mr. Arias was also generous with salary increases. Tocqueville predicted it.

Now Ms. Chinchilla’s “reform” proposes, among other things, a 14% value-added tax on all goods and services to replace a 13% sales tax on goods only and tax hikes on small and medium-sized businesses. Far from simply raising taxes on the rich, as the politicians want people to believe, this proposal will hit ordinary Costa Ricans hard.

Ms. Chinchilla’s party is salivating over the possibility of new revenue and the IDB is feeding the frenzy. In September it approved $609,000 for a project that its website says will “support” the “implementation of the tax reform proposal.” The IDB says how the money will be spent is not yet public information.

Tocqueville would have seen the danger: “The history of liberty is a history of the limitation of governmental power, not the increase of it.” But even he could not have anticipated today’s governmental excess encouraged by the IDB.

Source: Wall Street Journal

Discussion

No comments for “US: Tax ‘Experts’ Target Costa Rica – by Mary O’Grady”